August 2019 Budget

Let there be light! And yes, this is a picture of our bathroom… can you spot the cat?

Summer is coming to an end, which is sad… and also exciting because that means I get a paycheck again! Before October starts and my full paycheck kicks back in (I get a partial paycheck in September), I need to do an overhaul of our budget to re-evaluate how much we need to set aside for next summer. I’d also like to think through the exemptions we claim (I think that’s the right terminology) and maybe make some adjustments. We usually get a decent amount back during tax time and I’d rather have that money in each paycheck as opposed to getting a lump sum in April.

In other budgeting news, we (and by we I mean Mike, although I did hold the ladder and hand him stuff while he was up on the roof) did another major house project this month that involved cutting a hole in our roof! Mike installed a solar tube in our bathroom, which involved cutting a hole in the ceiling plus the roof, and then connecting them with the tube. A number of our neighbors have them and have raved about them. When Mike was buying the solar tube at the store, someone walked up to him and said, “you’re going to love that thing!” So, apparently they are pretty popular. Neither of us had heard of them until we moved to the PNW, so perhaps they are a regional thing? Or a ranch house thing? Anyway, we went from a pitch black bathroom to a bathroom that looks like the lights are always on (during the day at least), and it’s awesome! Ellie used to be wary of going into the hall bathroom because it was so dark, and now she’s fine, so that’s a win too! With that project we were over budget for housing (we used funds from our savings). We also took a trip, which put us over budget for travel (also using funds from savings). And then we had 2 wedding related gifts that we purchased this month. For pretty much all of these things we pulled money over from corresponding savings funds to cover the costs, as all of these things were planned (for the most part).

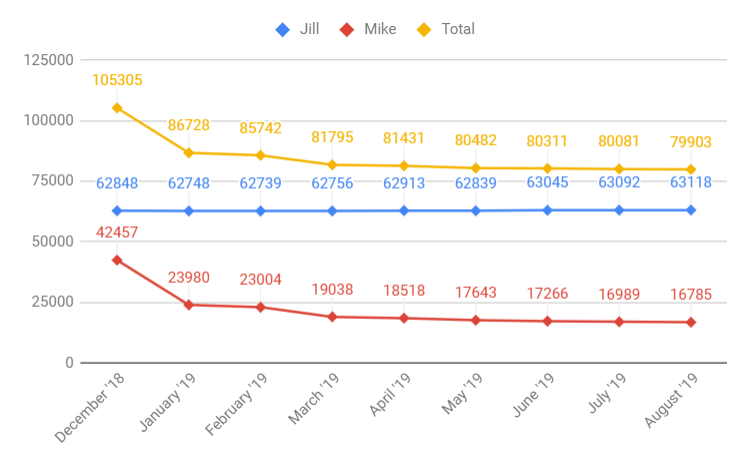

One final piece of budgeting news before I go into the numbers… we are officially under 80K on our student loan debt!!! 🎉🎉🎉

Previous budget posts can be found here: December 2018 (first post with background information), January 2019, February 2019, March 2019, April 2019, May 2019, June 2019, and July 2019.

August 2019 budget

Housing

Budgeted: 44.80%

Spent: 49.25%

over budget: 4.45% ⇒ moved $ from housing fund in savings

What’s included? Mortgage payment, property taxes, home insurance, home warranty, and any home improvement costs.

August notes: Summer months seem to equal house projects for us, the weather’s decent, our schedule is more flexible, and I don’t get a paycheck… so of course we want to spend money on the house, ha! This month, Mike installed a solar tube in our dungeon like hallway bathroom, using money we got from our birthdays. When all was said and done, it probably cost a little over $200 and the results are pretty awesome. We don’t need to turn the light on in the bathroom during the day anymore and despite the bathroom being straight out of the 1960s, it feels so much more modern with all the light coming in. It was definitely well worth the $ and effort.

Groceries

Budgeted: 20.19%

Spent: 18.56%

Leftover: 1.63% ⇒ using some of this to cover extra from gifts. Leaving the rest in our checking acct. so that we don’t have to pull as much from savings next month

What’s included? Food, non-food cooking stuff, toiletries, cat supplies, cleaning supplies, paper products, pharmacy… anything you can buy at the grocery store.

August notes: A pretty uneventful/regular month for our food budget. We did a big grocery trip on the very last day of August, which I could have put towards September’s budget; however, since we were still under budget I figured I’d include it in August.

Utilities

Budgeted: 6.36%

Spent: 5.40%

Leftover: 0.96% ⇒ using to cover amount over budget in gifts and clothing category

What’s included? Electric, gas, water, and trash.

Travel related expenses

Budgeted: 7.78%

Spent: 10.71%

Savings for yearly bills: 1.40%

over budget: 4.34% ⇒ moved $ from travel fund in savings

What’s included? Car insurance, gas, car registration (billed every 2 years), AAA (billed once a year), savings for a car maintenance fund, and a general travel fund for family visits and smaller local trips.

August notes: The second half of our airbnb bill hit for our trip at the end of August, so we pulled that amount from savings. Also our AAA bill hit for the year, so that was also pulled from savings (since we’ve been setting aside a small amount each month to pay for it)

Phone/internet

Budgeted: 3.38%

Spent: 3.01%

leftover: 0.37% ⇒ using to cover amount over budget in gifts category

What’s included? Phone bills, phone insurance, internet

Health

Budgeted: 0.63%

Spent: 0%

leftover: 0.63% ⇒ leaving in our checking acct. so that we don’t have to pull as much from savings next month

What’s included? Doctor’s bills (we also have an FSA but keep this additional fund to give us a little more padding just in case), a gym membership [officially dropping this while my back gets squared away], and a savings fund for a summer bootcamp (only taken out during school year).

Miscellaneous

Budgeted: 3.28%

Spent: 0.76%

savings for yearly bills: 2.31%

leftover: 0.21% ⇒ leaving in our checking acct. so that we don’t have to pull as much from savings next month

What’s included? A random assortment of things… jewelry insurance (billed once a year), a once a year haircut for me, Netflix, Prime membership (billed once a year), website hosting (billed once a year), and just a general miscellaneous category. For the things that are billed once a year, I just divide them by 12 and include it as a line on our budget each month, putting it into savings each month, letting it earn a tiny bit of interest. In early spring 2019 I added Ellie’s co-op preschool and 2 membership subscription sites that are blog related.

Dining out/entertainment

Budgeted: 1.12%

Spent: 1.16%

over budget: 0.04% ⇒ using extra from groceries to cover this

What’s included? Dining out/take out, museums, kid stuff (e.g., a class at the rec center for Ellie).

August notes: We did takeout on the last day of the month, after we finished up leftovers from our trip. Mike also went out for a beer after a preschool board meeting (no preschoolers in tow), and then I included parking for a trip to OMSI in here too (since it falls into the entertainment category). With those 3 things we went a tiny bit over budget.

Gifts

Budgeted: 0%

spent: 2.98%

over budget: 2.98% ⇒ moved $ from gift fund in savings and also used extra from utilities, phone/internet, and groceries to cover the extra

What’s included? Gifts, mainly for Ellie, sometimes for the occasional wedding or new baby. Mike and I don’t buy each other gifts (aside from the occasional food item during holidays/birthdays). We’ve got a gift moratorium going on for family/friends birthdays. Anything left over in this category gets put into our savings until we need it.

August notes: We had two wedding related gifts.

Clothing

Budgeted: 0%

Spent: 0.04%

over budget: 0.04 ⇒ covered with extra from utilities

What’s included? Clothes (pretty self explanatory)

August notes: Mike bought a hat from a thrift store to replace his old one that’s falling apart.

Retirement

Budgeted: 1.35%

moved to savings: 1.35%

What’s included: Monthly contributions to a Roth IRA

Student loans

Budgeted: 11.11%

Spent: 11.11%

leftovers from above categories: 0% (taking a break for the summer)

What’s included: Mike’s student loan payments and my student loan payments. The % budgeted/spent reflects our bottom line payment (e.g., our minimum payment amounts, plus a little extra on Mike’s so interest doesn’t accrue).

August notes: We’re under 80K! $97 under 80K, but that still counts!

August 2019 Loan Progress